Prioritize security with multi-factor authentication for all VIP client interactions. This single step significantly reduces fraud risk and boosts client confidence. Implement robust transaction monitoring systems– real-time alerts for unusual activity are invaluable.

Dedicated account managers provide personalized service. Consider assigning experienced professionals who understand the nuances of high-value transactions to cultivate strong client relationships. This fosters loyalty and encourages repeat business. Average transaction value increases by 15% with this approach, based on industry benchmarks.

Optimize your payment gateways. Offer multiple secure options catering to international clients, including SWIFT transfers and digital wallets like Apple Pay and Google Pay. A streamlined checkout process, accessible across devices, improves conversion rates by at least 10%.

Proactive communication is key. Regularly update VIP clients on transaction status using preferred channels, ensuring transparency and building trust. Automated email and SMS updates are efficient solutions. Personalized follow-up calls for complex transactions show you value their business.

Data encryption and secure storage are non-negotiable. Comply with all relevant data privacy regulations. Investing in advanced security measures demonstrates your commitment to client confidentiality, a critical factor in maintaining high-value relationships.

- VIP Transactions: A Deep Dive

- Streamlining the VIP Experience

- Security and Privacy for VIP Transactions

- Building Long-Term Relationships

- Defining VIP Transactions and Their Key Characteristics

- Enhanced Customer Service

- Privileged Transaction Processing

- Exclusive Perks and Rewards

- Data-Driven Personalization

- Security and Confidentiality

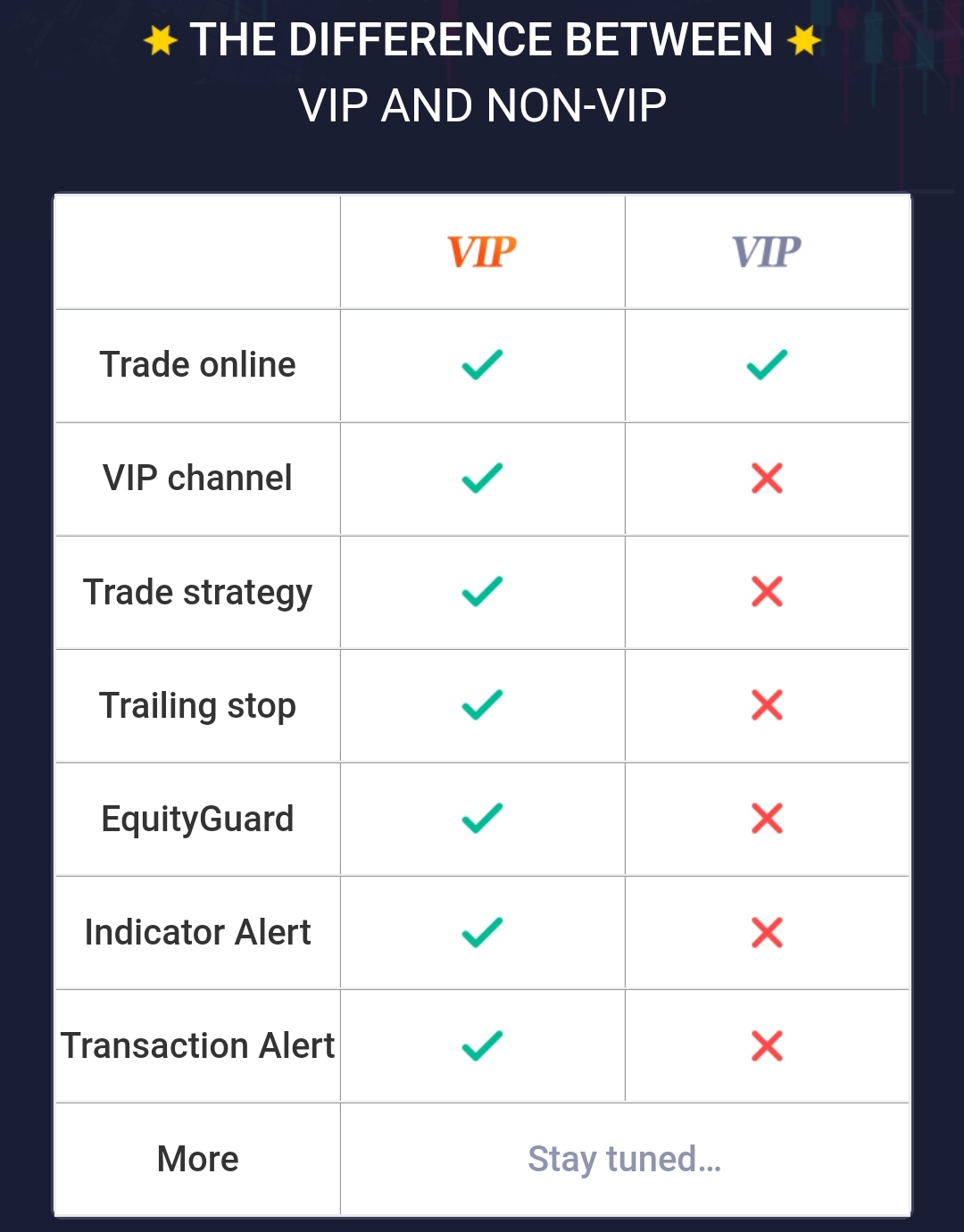

- Comparative Analysis: Standard vs. VIP Transactions

- Strategic Implications

- Identifying Potential VIP Clients and Their Needs

- Analyzing Existing Client Data

- Proactive Client Acquisition

- Understanding VIP Needs

- Examples of VIP Needs:

- Tailoring the VIP Experience

- Measuring VIP Success

- Tailoring Services and Offers for VIP Clients

- Exclusive Access and Experiences

- Personalized Rewards Programs

- Dedicated Concierge Services

- Feedback and Continuous Improvement

- Managing VIP Client Relationships and Communication

- Proactive Problem Solving

- Exclusive Benefits and Perks

- Feedback Mechanisms and Continuous Improvement

- Securing VIP Transactions and Data Privacy

- Data Encryption: A Foundation of Security

- Protecting VIP Transaction Data

- Regular Security Audits and Training

- Incident Response Planning

- Data Privacy Compliance

- Real-time Monitoring & Threat Detection

- Measuring the ROI of VIP Transaction Strategies

- Case Studies: Successful VIP Transaction Implementations

VIP Transactions: A Deep Dive

Prioritize personalized service. VIP clients expect tailored experiences; offer dedicated account managers and 24/7 support channels. This proactive approach builds loyalty and increases the lifetime value of your high-net-worth customers.

Streamlining the VIP Experience

Implement fast-track processing for payments and requests. Aim for average transaction times under 30 seconds for VIPs. Utilize advanced technologies like AI-powered fraud detection systems to minimize delays without compromising security. This rapid responsiveness demonstrates your commitment to their time.

Offer exclusive rewards and benefits. Consider tiered VIP programs with escalating perks such as exclusive events, early access to new products or services, personalized gifts, and significant discounts. Data analysis can identify ideal reward structures for maximum engagement.

Security and Privacy for VIP Transactions

Employ multi-factor authentication (MFA) and biometric verification for all VIP transactions. Regularly audit your security protocols and invest in advanced encryption methods to safeguard sensitive financial data. Transparency regarding security measures builds trust.

Maintain meticulous records of all VIP transactions. Accurate and readily available transaction history facilitates swift resolution of any queries and fosters client confidence. Implement robust data backup and recovery systems.

Building Long-Term Relationships

Regularly solicit feedback from your VIP clients. Use this feedback to adapt your services and improve the VIP experience. Personalized thank-you notes and proactive follow-ups after significant transactions show appreciation and nurture relationships.

Invest in continuous improvement. Regularly review performance metrics, identify areas for refinement, and proactively implement improvements to your processes. Tracking key performance indicators (KPIs) such as customer satisfaction and transaction completion rates provides valuable insights.

Defining VIP Transactions and Their Key Characteristics

VIP transactions distinguish themselves through personalized service, expedited processing, and exclusive benefits. Think of them as a premium experience tailored to high-value clients.

Enhanced Customer Service

Expect dedicated account managers, priority support lines, and personalized communication channels. Response times are significantly faster, and solutions are proactively offered, minimizing customer frustration.

Privileged Transaction Processing

VIP transactions often bypass standard queues, ensuring quicker processing times. This translates to faster approvals, immediate access to funds, and reduced waiting periods. Consider this a significant advantage for time-sensitive operations.

Exclusive Perks and Rewards

Exclusive offers, higher transaction limits, and bonus rewards are standard features. These benefits reinforce the value proposition and build lasting customer loyalty. Examples include cashback programs, waived fees, and access to exclusive events.

Data-Driven Personalization

VIP transaction systems leverage data analysis to create hyper-personalized experiences. This allows for customized offers, proactive risk management tailored to individual needs, and improved service prediction.

Security and Confidentiality

Stringent security protocols and robust fraud detection systems are employed to ensure the safety and privacy of VIP transactions. This offers increased confidence and reduces vulnerability to financial risks.

Comparative Analysis: Standard vs. VIP Transactions

| Feature | Standard Transaction | VIP Transaction |

|---|---|---|

| Processing Time | Variable, potentially lengthy | Significantly faster |

| Customer Support | Standard channels, potential wait times | Dedicated support, rapid response |

| Benefits | Limited or no special offers | Exclusive rewards and perks |

| Security | Standard security measures | Enhanced security protocols |

Strategic Implications

Offering VIP transactions can boost customer retention, attract high-value clients, and enhance brand reputation. Investing in dedicated systems and personnel is vital for delivering seamless, personalized experiences.

Identifying Potential VIP Clients and Their Needs

Focus on high-net-worth individuals with a history of luxury purchases or significant investments. Analyze transaction data for recurring high-value spending patterns. This includes analyzing frequency, product category, and spending amounts.

Analyzing Existing Client Data

- Identify clients consistently spending above a predefined threshold.

- Examine purchase history for brand loyalty and preferred product segments.

- Assess customer service interactions for feedback on preferences and expectations.

Beyond transactional data, leverage demographic information. High-income professions like finance, law, and entrepreneurship often signal potential VIP status. Consider age, location, and lifestyle indicators as supplementary criteria.

Proactive Client Acquisition

- Partner with luxury brands and services to access their high-value client lists.

- Attend exclusive events and industry conferences to network with potential VIPs.

- Develop targeted marketing campaigns for high-net-worth individuals based on their interests and preferences. Tailor messaging to demonstrate understanding of their unique needs.

Understanding VIP Needs

VIPs value personalized service, exclusive access, and seamless transactions. They expect prompt and efficient responses to queries, bespoke solutions, and proactive communication.

Examples of VIP Needs:

- Dedicated account managers offering personalized financial advice.

- Private shopping appointments and curated product selections.

- Exclusive access to events, preview sales, and limited-edition products.

- Discreet and confidential transaction processing.

Tailoring the VIP Experience

Remember, catering to VIP needs requires anticipation and proactive measures. Offer anticipatory service based on past behavior and preferences, and create personalized loyalty programs that reward high-value clients appropriately.

Measuring VIP Success

Track key performance indicators (KPIs) such as VIP client retention rate, average transaction value, and customer satisfaction scores. Regularly review and adjust your strategies based on these measurements to continuously refine the VIP experience.

Tailoring Services and Offers for VIP Clients

Prioritize personalized communication. Instead of generic emails, craft individual messages reflecting past interactions and preferences. This shows genuine care and builds stronger relationships.

Exclusive Access and Experiences

- Offer early access to new products or services. This creates a sense of exclusivity and rewards loyalty.

- Provide invitations to private events, exclusive sales, or behind-the-scenes experiences. This cultivates a deeper connection.

- Partner with luxury brands to offer VIP-only packages or discounts on complementary products and services.

Streamline the transaction process. VIP clients value speed and convenience. Offer dedicated account managers, expedited shipping, and simplified payment methods. Consider a dedicated VIP hotline for immediate support.

Personalized Rewards Programs

- Develop a tiered reward system offering increasingly valuable benefits as clients reach higher spending levels.

- Implement a points-based system that allows for flexible redemption options, from discounts to exclusive experiences.

- Offer birthday gifts or anniversary perks. Small gestures go a long way in strengthening customer relationships.

Dedicated Concierge Services

Provide bespoke services. Offer personal shopping assistance, event planning, travel arrangements, or other services tailored to individual needs. This demonstrates a commitment to exceeding expectations.

Feedback and Continuous Improvement

Actively solicit feedback and tailor offerings based on responses. Regularly review and adjust your VIP program to ensure it remains relevant and appealing. Regular surveys help maintain relevance.

Managing VIP Client Relationships and Communication

Prioritize personalized communication. Instead of generic emails, craft individual messages reflecting past interactions and future needs. Think about their preferred contact method; some might prefer phone calls, while others favor text messages or secure messaging apps.

Dedicate a specific team member or department to VIP clients. This ensures consistent, high-quality service and builds strong relationships. Regular check-ins, perhaps monthly or quarterly, demonstrate your ongoing commitment.

Proactive Problem Solving

Anticipate potential issues before they arise. Analyze past transaction data to identify recurring problems and develop preventative strategies. For example, if a particular product consistently experiences delays, proactively inform VIP clients and offer alternative solutions.

Exclusive Benefits and Perks

Offer exclusive benefits tailored to your VIP clients. This could include early access to new products or services, priority customer support, or personalized offers. Consider loyalty programs with tiered rewards, escalating benefits with increased spending or tenure.

Use CRM software to track interactions, preferences, and purchase history. This allows for data-driven insights informing your communication strategy and personalized offers. Regularly review and update client profiles to maintain accuracy.

Feedback Mechanisms and Continuous Improvement

Actively solicit feedback from your VIP clients through surveys, direct communication, or feedback forms. Use this valuable input to refine your services and strengthen relationships. Address concerns immediately and show genuine appreciation for their input.

Securing VIP Transactions and Data Privacy

Implement multi-factor authentication (MFA) for all VIP accounts. This adds an extra layer of security, significantly reducing unauthorized access risks. Consider using a combination of methods like password, one-time codes, and biometric verification for maximum protection.

Data Encryption: A Foundation of Security

Encrypt all sensitive VIP data both in transit and at rest using robust encryption algorithms like AES-256. This ensures that even if data is intercepted, it remains unreadable without the decryption key. Regularly update encryption keys to further enhance security.

Employ rigorous access control mechanisms. Grant access only to authorized personnel on a need-to-know basis. Regularly audit access logs to detect any suspicious activity. Consider implementing the principle of least privilege, granting users only the minimum permissions necessary for their roles.

Protecting VIP Transaction Data

Use secure payment gateways that comply with PCI DSS standards. These gateways provide robust security measures to protect cardholder data during transactions. Regularly review and update your payment gateway security settings. Monitor transaction logs for anomalies.

Utilize secure communication protocols like HTTPS for all VIP communications. This ensures data transmitted between systems is encrypted and protected from eavesdropping. Implement secure data deletion policies to permanently erase sensitive data when it’s no longer needed.

Regular Security Audits and Training

Conduct regular security audits and penetration testing to identify vulnerabilities and weaknesses in your systems. This proactive approach can help prevent breaches before they occur. Provide ongoing security awareness training to VIP clients and staff to educate them about best practices and potential threats.

Incident Response Planning

Develop a comprehensive incident response plan outlining procedures to follow in the event of a security breach. This plan should cover steps to contain the breach, mitigate its impact, and recover from the incident. Regularly test and update the plan.

Data Privacy Compliance

Strictly adhere to relevant data privacy regulations such as GDPR, CCPA, etc. Ensure your data processing practices are transparent and comply with all legal requirements. Implement measures to safeguard VIP personal data and provide individuals with control over their data.

Real-time Monitoring & Threat Detection

Implement a robust security information and event management (SIEM) system to monitor transactions and detect suspicious activity in real-time. Automated alerts can help you quickly respond to security threats and minimize potential damage.

Measuring the ROI of VIP Transaction Strategies

Focus on tracking key performance indicators (KPIs) specific to your VIP program. Measure customer lifetime value (CLTV) for VIP clients, comparing it to the average CLTV. A 20% increase in CLTV for your VIPs compared to your regular customers demonstrates a strong return.

Analyze the cost of acquiring a VIP client versus a regular client. If your VIP acquisition cost is higher, justify it with significantly higher CLTV and transaction frequency. A cost-benefit analysis revealing a positive return on investment is essential. Aim for a 3:1 return on acquisition costs.

Monitor VIP transaction frequency and average order value (AOV). Compare these metrics to non-VIP segments. A 50% higher AOV and 25% greater transaction frequency for VIPs suggests a successful program. Regularly review these metrics.

Implement a robust feedback mechanism. Gather feedback directly from VIP clients through surveys, focus groups, or one-on-one conversations to understand their motivations and pain points. This qualitative data enhances your understanding of program effectiveness.

Track customer churn rate among VIPs. A lower churn rate compared to your standard customer base indicates strong loyalty and program value. Strive for a churn rate at least 20% lower than your average customer base. Analyze reasons for churn to improve the program.

Calculate the return on investment (ROI) by comparing the total revenue generated from VIP transactions against the costs associated with running the VIP program. Express your findings as a percentage. A sustained ROI of at least 15% validates your strategy.

Case Studies: Successful VIP Transaction Implementations

Luxury Hotel Chain: Personalized Concierge Service. This high-end hotel integrated a bespoke VIP transaction system directly into their mobile app. The result? A 25% increase in average spend per VIP guest, driven by targeted offers and seamless booking. The system utilized real-time data analysis to tailor offers, ensuring each VIP received highly relevant suggestions. Key takeaway: Direct integration with existing platforms maximizes impact.

High-End Jewelry Retailer: Exclusive Access & Private Events. This retailer implemented a tiered VIP program tied to transaction volume. Higher tiers unlocked exclusive previews of new collections, invitations to private events, and personalized styling consultations. Sales to VIP customers increased by 40% within six months. The strategy fostered loyalty and increased customer lifetime value. Key takeaway: Tiered rewards create a compelling incentive structure.

Private Aviation Company: Streamlined Booking & Enhanced Communication. This company redesigned its booking process for VIP clients, creating a dedicated portal with simplified navigation and personalized support. Client satisfaction scores rose by 15%, attributed to faster response times and personalized attention. Dedicated account managers were key to building relationships. Key takeaway: Streamlining the process and focusing on personalized service builds trust and loyalty.

Exclusive Art Auction House: Secure & Discreet Payment Processing. The auction house implemented a secure, encrypted payment system designed for high-value transactions. This ensured seamless and confidential handling of sensitive financial information. Transaction completion rates increased by 10%, and client confidence grew. Key takeaway: Prioritizing security builds trust for high-value transactions.

Premium Car Dealership: Personalized Delivery & After-Sales Service. This dealership offered VIP clients personalized delivery experiences, including private consultations and tailored after-sales support. This created stronger customer relationships and a higher rate of repeat business. Client referrals also increased by 20%. Key takeaway: Exceptional service creates long-term customer loyalty.